Your Financial Institution’s Growth Platform

Glide redefines account opening and loan origination with seamless, AI-powered digital experiences. Deliver growth, elevate customer experiences, and streamline operations through intelligent automation.

Boost deposits

Increase deposits with frictionless account opening and personalized onboarding. Make your institution the primary financial choice for your members.

Drive loan growth

Streamline loan applications with fast, intuitive , and unified deposit and loan applications. Boost approvals and cross-selling with personalized offers tailored to your customers’ needs.

Leverage AI and Automation

Streamline workflows, reduce manual tasks, and deliver faster, smarter onboarding and lending experiences for your customers with AI. Protect your institution with advanced fraud detection tools.

Glide connects to all of the most popular core systems and tools. Designed with collaboration and compatibility in mind, Glide supports a wide range of integrations to ensure a unified and efficient workflow for your financial institution.

More Members. Less fraudsters. Higher engagement.

FOR CUSTOMERS

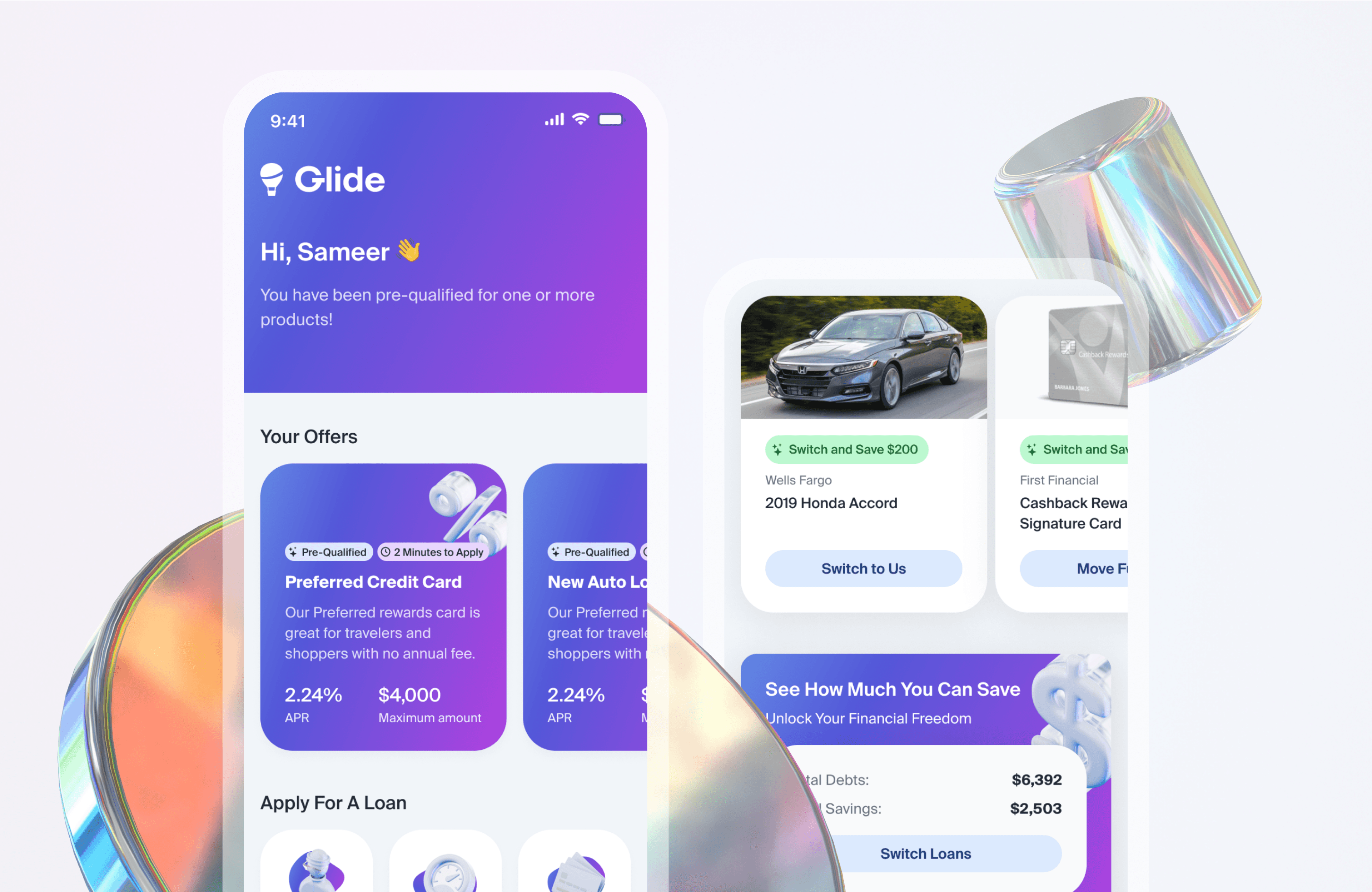

Instantly Apply for Accounts and Loans

Revolutionize account opening with Glide's seamless, 2-minute mobile-first platform designed for credit unions and banks. Say goodbye to friction, streamline activations, and prevent fraud—all while saving time for customers and employees alike.

Frictionless Digital Onboarding: Mobile-first applications with pre-fill and lightning-fast processing.

Full Account Support: Open personal, business, trust, and other account types effortlessly.

Post-Application Engagement: Activate accounts with funding, direct deposit setup, and digital banking enrollment.

FOR STAFF

Automated Tools for Smarter Decision-Making

Empower your employees with modern tools that automate workflows, enhance security, and provide deeper insights. Glide ensures faster, smarter onboarding at every step.

Faster Decisions: Aggregate customer data, documents, and risk checks for instant decision-making, saving valuable time.

Omni-Channel Support: Seamlessly handle applications in-branch, in-person, or online, ensuring a unified experience.

Enhanced Security: Protect your institution with advanced fraud detection, KYC tools, and over 100+ risk signals for thorough assessments.